Form t1028 your rrsp information for 2019.

Rrsp maximum 2018.

You can find your registered retirement savings plan rrsp or pooled registered savings plan prpp deduction limit often called your contribution room by going to.

You may contribute to your rrsp until december 31 of the year in which you reach age 71.

The 2019 2020 deduction limit explained.

Cra may send you a form t1028 if there are any changes to your rrsp deduction limit since your last assessment.

For most people earned income for rrsp purposes is.

Use the following rrsp contribution calculator to determine your maximum rrsp contribution.

Maximum amount deductible rrsp pension adjustment pa 2017 pension adjustment reversal par for 2018 2017 unused rrsp amount deductions past services pension adjustment for 2018.

The amount of rrsp contributions that you can deduct for 2018 is based on your 2018 rrsp deduction limit which appears on your latest notice of assessment or notice of reassessment or on a t1028.

18 of your earned income from the previous tax year.

How is your rrsp limit calculated.

The rrsp deduction limit for the 2019 tax year is 18 of a taxpayer s pre tax earned income for 2019 or 26 500 whichever is less.

This is less than the maximum deduction limit.

Your allowable rrsp contribution for the current year is the lower amount of the following.

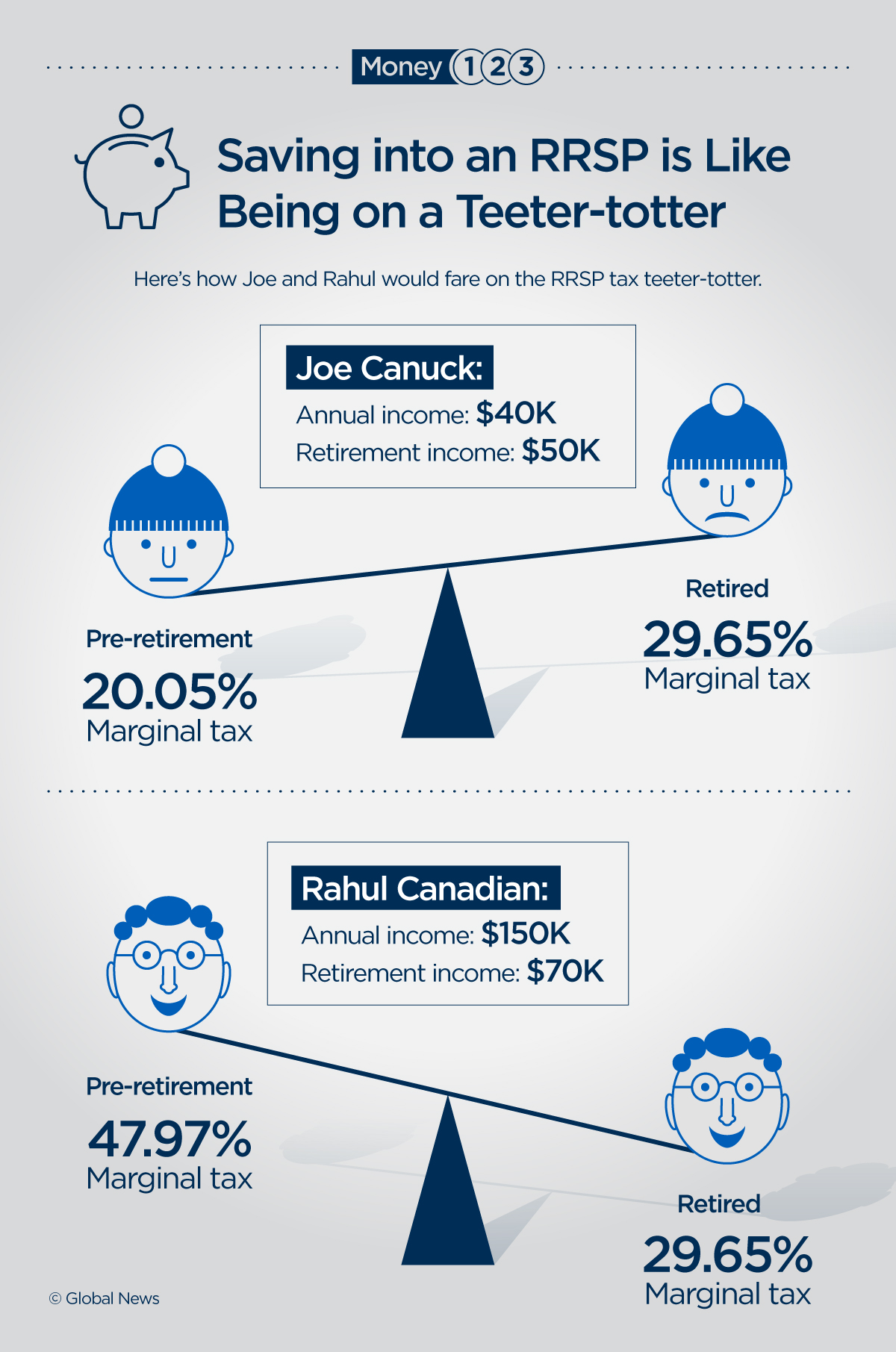

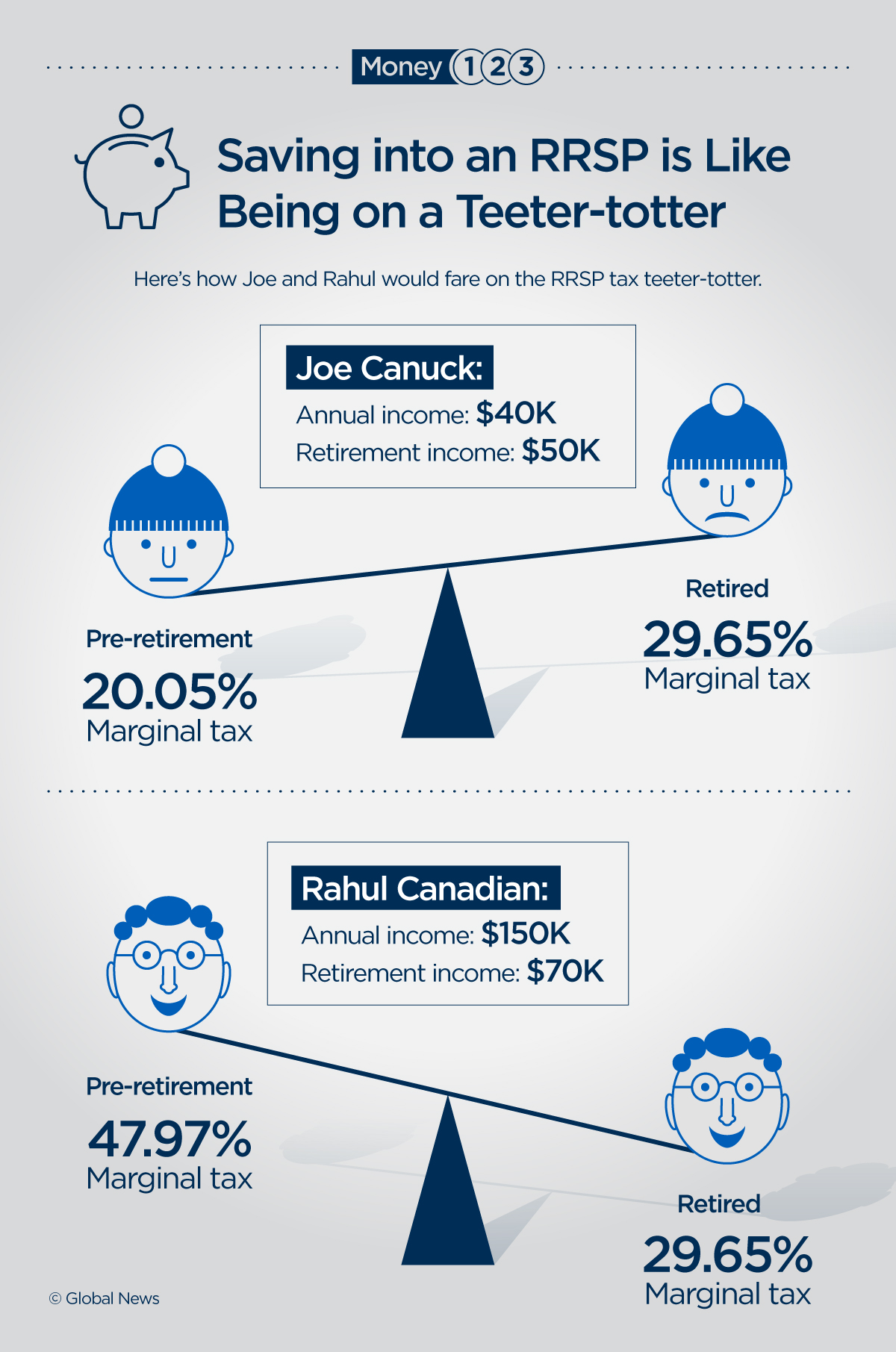

The maximum you can save into an rrsp every year is 18 per cent of your pre tax earned income from the previous year up to a ceiling that gets bumped up a bit every year.

For 2017 that s.

Earned income x maximum rate allowable for rrsp 18 100 maximum amount deductible rrsp take the lower of the previous calculation and rrsp deductible limit for 2018.

Contribution year 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 please select an item.